No AI or fintech app will ever disrupt this Arizona-based financial advisor

Photo courtesy of Watermark Wealth Strategies

Opinions expressed by Digital Journal contributors are their own.

The word “disruption” gets thrown around a lot these days.

In an age of AI, apps, and algorithms, it’s hard to find industries that are immune to technological innovation (or outright replacement). Just like the people who once churned butter by hand, even long-time industry professionals wonder if their job is next on innovation’s hit list.

Financial planning is no exception. It’s next to impossible to watch TV or browse the internet without being advertised as an app that puts a robo-advisor right into your pocket. But while the marriage of Silicon Valley and Wall Street paints a pretty picture for the future — will Fintech really become people’s first choice when it comes to retirement planning?

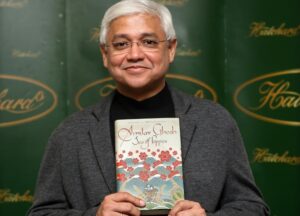

One Arizona-based financial advisor, Kyle Richardson, doesn’t see his work getting “disrupted” anytime soon.

“People don’t want to just use a computer,” Richardson says, “they want to have that personal relationship with their retirement planner.”

Richardson — Founding Partner of Watermark Wealth Strategies — has market research backing him up on this, including Fidelity® research revealing that 63% of Gen Z and millennial investors “believe working with an advisor is key to achieving financial success.”

You’d think that this would be the demographic most open to disruption — but this younger audience is looking for more than simple “risk tolerance” quizzes and autogenerated portfolios.

For Richardson, this is affirmation his firm is headed in the right direction.

“There’s an awesome type of relationship that we get to form with the people we work with,” he says. “It’s symbiotic. There’s a mutual respect — and when we build the trust factor, it just becomes enjoyable.”

The 25-year industry veteran describes Watermark’s primary client base: a hardworking set of families who mostly work in the aerospace industry. Some work in engineering at Honeywell, others at Intel. The majority have spent their career with Southwest.

“We tend to really connect with Southwest,” Richardson says, “because a lot of those employees have worked there for 20 to 30 years. It’s a family. They want a financial advisor that’s going to treat them the same way — and it’s just been a magnetic relationship.”

Not exactly something a robo-advisor could take pride in. The rise in cold, calculating Fintech “disruptors” has actually reaffirmed the value of a good financial advisor. But it’s not just about sticking with the traditional model for retirement planning, just because it beats an app. It’s about raising the bar for what’s expected of financial advisors.

For Watermark, that means building even closer relationships with clients.

And if you’ve never drank beer or competed in a chili-cooking competition with your financial advisor, you’re missing out. These are all things that Watermark brings to the table.

“It takes time to build and bridge trust,” Richardson says. “That’s a big part of the reason we like to run all these goofy events. We have food trucks, happy hours, and Top Golf — all kinds of stuff that builds trust faster.”

That’s an extra mile you’d be hard-pressed to get from the many other firms out there.

And the fun and games aren’t just there to build trust — they’re also for gaining insight that ensures each plan is fitting and actionable for the specific family at hand.

“After a glass of wine,” the financial advisor laughs, “I learn a lot more about the client than I do in my conference room.”

“We engage our clients in different ways,” he continues. “Everyone has different plans for their retirements, and many have specific amounts of money that they want to leave for their kids. Everything is customized on the granular level.”

Phase one of Watermark’s process focuses on the discovery of these needs and goals. From there, the team gets to work on strategy, implementation, and continued monitoring that ensures the client’s finances keep trending towards the big goals their clients are working towards.

But this discovery process doesn’t stop after the first consultation. It’s an ongoing process — one of the many reasons why Richardson is excited to keep holding monthly events with his clients.

These relationships are at the core of Watermark’s success — and so personalized that the firm is irreplaceable no matter where the future of wealth management lies. They’ve also earned Richardson and his team accolades, such as their recent inclusion in LPL Financial’s 2024 Summit Club as a Top 1% performing firm. Richardson — known to just keep his head down and work hard — was “slightly overwhelmed” by this award, coming from the largest independent broker-dealer in the US.

“Watermark has the best team we’ve ever had in place,” he says. “Without them, we never would have gotten a recognition like this. They make me look good. They take great care of our clients. We all have a mission of exceeding client expectations at every touch.”

This is something that technological innovation could never revolutionize. By tripling down on the personal touch, Watermark has made its approach to relationship-building the most exciting thing in the industry today.

Now that’s disruptive.

To learn more about Watermark Wealth Strategies, visit their website.

No AI or fintech app will ever disrupt this Arizona-based financial advisor

#fintech #app #disrupt #Arizonabased #financial #advisor