Op-Ed: ‘Back to the office’ has failed to improve commercial property bottom lines. Now what?

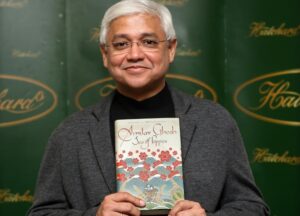

Troubled Chinese property developer Evergrande $1.1 billion Hong Kong headquarters – © AFP ISAAC LAWRENCE

You know it’s going to be fun in the old commercial property pigsty when the IMF says you have a sector-wide major problem. That was back in January. Things haven’t changed.

People went back to the office, particularly in the USA. Nothing much happened to commercial property values, debts, or simple tenancy statistics. It’s more like Back to Square One, with a decade’s worth of added costs for everyone. A warning was issued about the sector as a whole, and it’s been pure denial ever since.

This is why this matters so much to everyone:

The trouble with this sparkling picture of a sector in self-righteous senility is that a lot of big money is tied up in commercial property. Banks and other creditors in the property sector are especially vulnerable. Risks could be extremely difficult to manage. If the commercial property market goes, their portfolios of loans are compromised. Their borrowing costs will be hit out of the ballpark. Rates will go up as a result, far beyond the rises of the last couple of years.

The current mess has been allowed to accumulate debt and financial obsolescence while destroying itself. Most of these commercial developments are based on a world that doesn’t exist anymore. It started to become an unavoidable reality a decade or so ago. The malls were the first sign that it was over. Retail is still in its usual unconvincing apologist crash-and-burn mode.

This will get worse over time. The future is almost here, and it looks nothing like the present. AI will obliterate office work and office workers. No part of life will be the same again. There will be no office to go to, soon enough. If the phone was an office in your pocket, AI is a network in your pocket.

Commercial property is the dodo in the blender. Who needs an expensive, purposeless doll’s house full of overpaid insular idiots? Commercial property may not even exist in this environment. If there’s one thing in business that never changes, it’s “cheaper is better”. The more expensive something is, the more likely it is to get thrown out in the trash.

Commercial property rentals aren’t even getting lower. They’re not trying to adjust. They may well be locked into higher rents at exactly the wrong time. In the US renting out a square foot of commercial desert is a few bucks more expensive. That’s despite the obvious implosion of the sector. You pay more for something that’s worth less. Not because it makes sense or attracts tenants but because it balances the books.

The market is as usual talking itself up. That’s how property prices went out of control. When even newspapers turn into unashamed shills for inflated prices, reliable information doesn’t stand a chance. So what? Maybe someone believes it, but creditors won’t. Nor will real costs. It’s unlikely anyone believes this dribbling rubbish, anyway. Would you invest billions in a sector which is visibly falling to bits, just because some bozo with a byline says you should?

The whole issue boils down to one simple fact. People just do not do business like that anymore. They don’t buy and sell like that. They don’t need the added costs. These places no longer generate business simply by being there. Commercial property in its current mode is a truly lousy fit.

The problem is that the sector hasn’t adapted for far too long. Nobody has been thinking about how to create a good fit for actual needs. Living costs are way up. Spending power is that much further down. This is Bonehead Economics 101, absolutely basic. The sector seems to think that people will spend money they don’t have on things they can get cheaper elsewhere, including spaces for workers. Why?

The real killer is that businesses should have been saving a fortune from working from home. So should employees. No commuting. No ridiculous office running and maintenance costs. Smaller space requirements. More hours in the day for work. Order what you need online and save time and money. This list of savings is almost literally endless (It’s called “actual productivity”, as distinct from “it’s productive because we say it’s productive).

The other possibility for this situation is psychological. People grew up with the office or workplace image. Maybe they think this is how it should be. The trouble with that is that how it should be is rarely if ever how it is.

…But somehow, instead of reconfiguring office spaces and making things more affordable, they lost out on it. Warehousing is the only show in town now. Even basic distribution has changed beyond recognition, and the sector is refusing to acknowledge it.

This is some sort of strange mix of “traditional values” and being utterly oblivious to commercial realities. If people can’t afford to rent their own homes, what the hell makes you think they’re going to prop up an entire property sector?

The actual problems couldn’t be any simpler. The fixes couldn’t be simpler:

Repurpose commercial spaces.

Go into residential and hybrid property mode or anything else that is actually useful to someone.

Cut your self-inflicted costs and do something about that ridiculous level of debt.

Stop charging out-of-touch prices for commercial spaces.

Remote workers have more available cash. Let them work from home.

Realize that the word “affordable” has practical applications.

Stop overvaluing these damn dino-properties like it’s 1985. A lot of your debt comes from right there.

Grow up.

___________________________________________________________________

Disclaimer

The opinions expressed in this Op-Ed are those of the author. They do not purport to reflect the opinions or views of the Digital Journal or its members.

Op-Ed: ‘Back to the office’ has failed to improve commercial property bottom lines. Now what?

#OpEd #office #failed #improve #commercial #property #bottom #lines