Op-Ed: Privatization and deregulation – Two total failures in overpriced clown suits

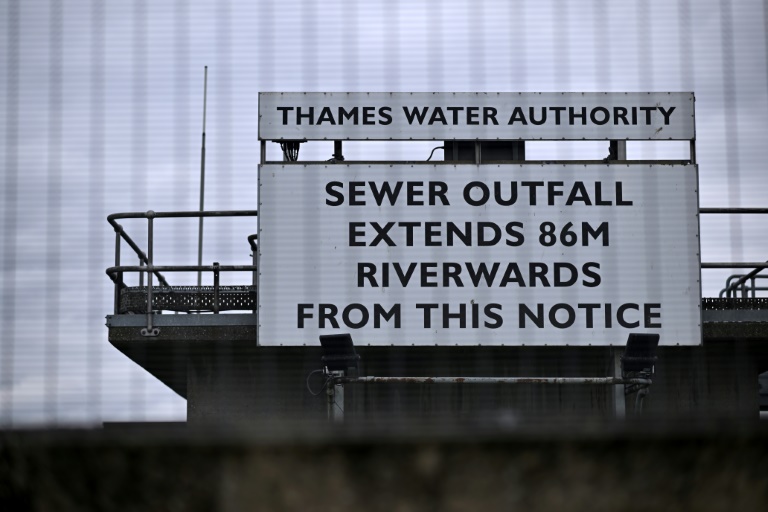

Privatised UK water companies have been releasing raw sewage into rivers and along beaches – Copyright AFP Ed JONES

Somebody said, “Let’s run government like a business”. The sages duly replied, “Duh… OK”, and this festering sewer of a mismanaged world was born.

The statement really meant “Let’s run something that isn’t, shouldn’t. and can’t be a business like a business”, but by then it was too late. The Western world in particular played fetch with these two dried sticks of bad ideas.

The theory of privatization is that it saves governments money and reduces bureaucracy. It doesn’t. The whole idea of privatization is ludicrous, and it can prove it.

Just search the news for privatization any day of the week. A lot of large sources of revenue have been given to the private sector, which then only pays taxes at virtual gunpoint if at all.

It’s like giving away your job and your life savings and being compensated with a cardboard cutout of Margaret Thatcher or Ronald Reagan. If you feel compensated, there’s something seriously wrong with you and your education.

To give some idea of how privatization works, here’s a tale from my own country of Australia. There’s a figure floating around that says Australia has saved $100 billion since the 1990s due to privatization. I won’t link that suspiciously round neat number because I don’t believe it.

The true value of this mystical number becomes a bit more comprehensible when you realize that our GDP is over $1.5 trillion per year. So we’ve saved the equivalent of a few weeks of GDP in 30-plus years. In those same 30 years, everything has got a lot more expensive.

May we all swoon with admiration now?

There is no way this pitiful sum could possibly equal the revenue of the public services we privatized, let alone their actual value.

More to the point – Efficient services add value and cost less. Without exception, privatization invariably leads to higher prices.

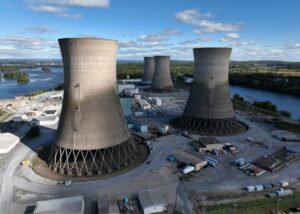

Meanwhile, we also gave away huge multi-billion cash cows in our telecommunications, including the infrastructure, energy sector, and so on. These services were relatively cheap. This opened up “competition” in the form of very similar prices and business models.

Our public and essential services, built and paid for by generations of public money, are now either far more expensive or non-existent. You used to pay taxes for services. Now you pay taxes, and you either get nothing in return or might see the services occasionally if you’re lucky. Underfunding is chronic.

On the other side of this very tarnished and largely worthless coin is deregulation. Regulations are just rules. The idea is that everyone plays by the same rules. Most people do, and there’s usually a howl of indignation if they don’t. Simple enough, surely.

The same half-witted logic applies. “Cutting bureaucracy” means that you now need a court case to stop people from breaking the law. They just pay a fine and keep breaking it, instead of being shut down until they’re compliant.

The byproducts of this whimsical flight into fecal fantasy are rampant fraud and corruption. Prices are no longer under control. Unaffordability is universal. Basics are under constant threat of cost increases. Poverty has increased due to a system that is basically unaccountable for anything and everything.

Most of the corporate world is also heavily in debt. Therefore the maniacal drive to raise prices. Well, that and ridiculous compensation for underperformance at all levels of executive management.

“Efficiency”, you say?

“When?”, I enquire.

Ideologically, it was already idiotic and now it’s even worse. The argument against public ownership was that it was “socialist”. Yeah, sure.

The US, UK, Australia, Canada, and Europe were monuments to socialism, were they? No, they weren’t, aren’t, and never will be. Nothing of the sort, at any time. The USSR perhaps the very last word in economic inefficiency and mismanagement, was used as an example of socialism. Now everyone does business with communist China, and that’s OK.

The unavoidable fact is that prices have spiked continuously since privatization and deregulation became pinups for politics. Poverty has also spiked. Governments have effectively given away their powers to regulate.

Now we get around to the other point(s) of this article.

The future is looking very stupid right now with these failed business models as the only options. It can get a lot stupider, too.

Now, having failed utterly, the crusade for privatization and deregulation continues. In Europe, the saintly finance sector is pushing for more deregulation. Wearing Gucci sackcloth and ashes, they want a bit more leeway. Presumably so their political choirs will sing more sweetly and flutter about like moths more daintily.

…Or maybe not. The global finance sector is living largely on a combination of fiction and monetary masturbation. Global debt now weighs in at a bonny bouncing $315 trillion.

Come off it.

The whole sector needs to severely rationalize. It needs regulation because it can’t stop printing non-existent money to generate more debt. Everyone’s that much poorer as a result.

De-privatize, re-regulate, and lose the morons. Those are your options.

Op-Ed: Privatization and deregulation – Two total failures in overpriced clown suits

#OpEd #Privatization #deregulation #total #failures #overpriced #clown #suits