5 charts that break down the NBA’s new media rights deal

To quantify the impact of the NBA’s new media rights deal, Sqore compiled five charts that break down the league’s revenue, standing, and more.

– Ezra Shaw // Getty Images

Mike Taylor, Data Work By Karim Noorani

The National Basketball Association has been ascendant for decades, and yet another influx of cash promises to keep the league near the top of the sports media ecosystem for years to come.

In July, the NBA inked 11-year contracts worth $76 billion with the Walt Disney Company, NBCUniversal, and Amazon Prime Video to broadcast games starting next season. It will increase the game’s reach in the United States and around the world, as Commissioner Adam Silver said when the agreements were announced. It will also contribute to further increases in player salaries and a rising salary cap, help close the gap to the NFL’s #1 spot in the landscape, and boost the continued growth of the WNBA and its players.

Since Larry Bird, Magic Johnson, and then Michael Jordan were drafted from college to the pros in 1978, 1979, and 1984, the NBA has not looked back. A league that didn’t even televise its most important matchups live as recently as 1981—six NBA Finals games from ’79 to ’81 were tape-delayed, if you can believe that—has turned into a behemoth that rivals the new American pastime, the National Football League.

In recent years, this mushrooming has been driven by an explosion in 3-point shooting and the game-changing players who can drain shots from near half court with the ease of an uncontested layup. Stephen Curry, of course, is and will remain the vanguard of this movement for a long time. The rise in 3-pointers makes games more exciting and unpredictable, cultivating an environment in which media companies, desperate to prop up their splintering bases, will shell out unfathomable sums to secure rights to coveted competitions.

To quantify the impact of the NBA’s new media rights deal, Sqore compiled five charts that break down the league’s revenue, the league’s standing in the sports media industry, player salary implications, and how the WNBA will benefit, too.

![]()

Sqore

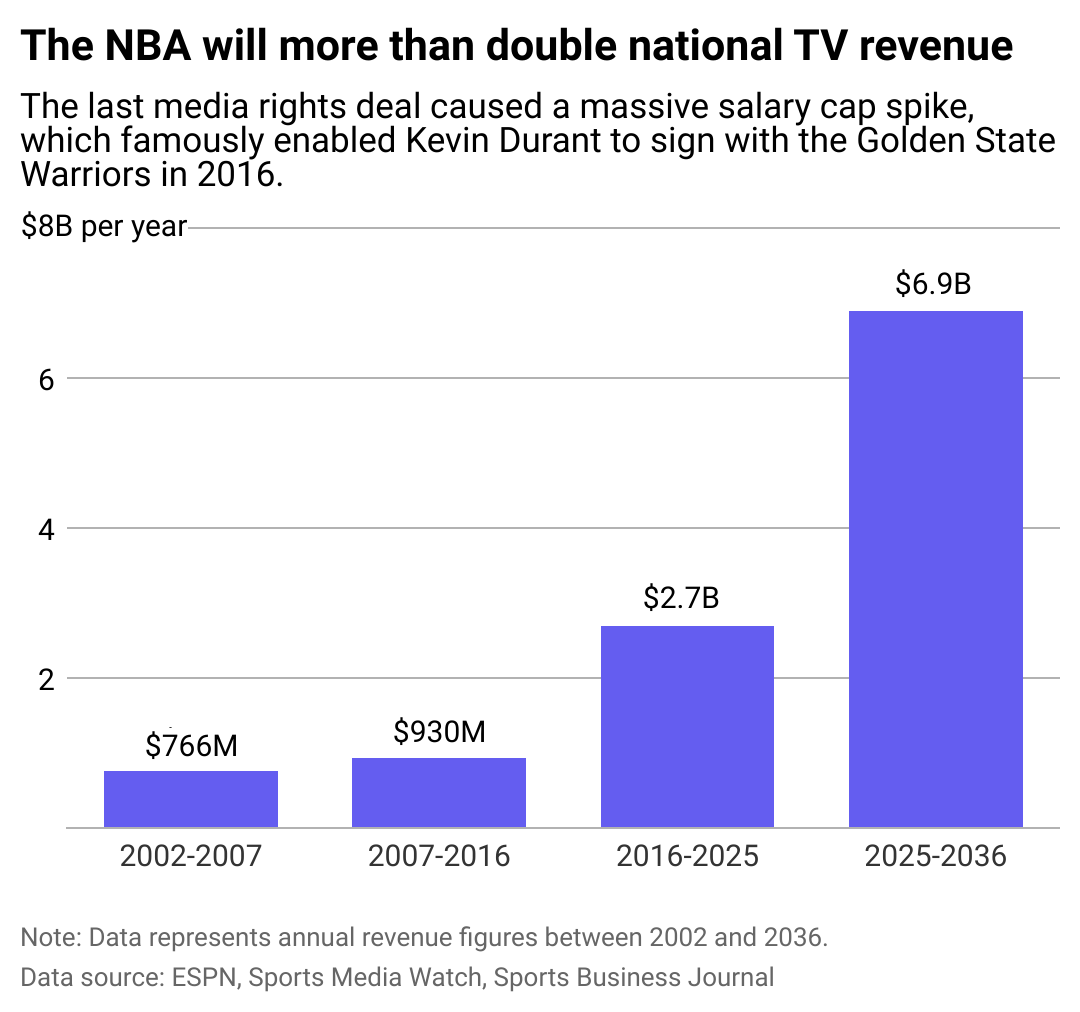

Television value has soared since 2016

The NBA’s media rights deals have always grown exponentially. This one is worth so much because what used to be simple TV broadcast rights—first network and then network plus cable—now encompass streaming services and even ticketing, merchandising, and sponsorships in addition to licensing, production, and distribution.

The league is also better prepared this time to absorb the shock of such a massive deal, which means players, team owners, and fans may all sit back and enjoy the spoils. There will be more games on TV, more games livestreamed, a wider global audience, and a new hub of commentary and analysis without TNT’s preeminent “Inside the NBA” show.

Growing pains are sure to follow with unseasoned broadcasters, but there’s also the opportunity for expansion teams in Las Vegas, Seattle, and beyond—Europe, anyone?

Sqore

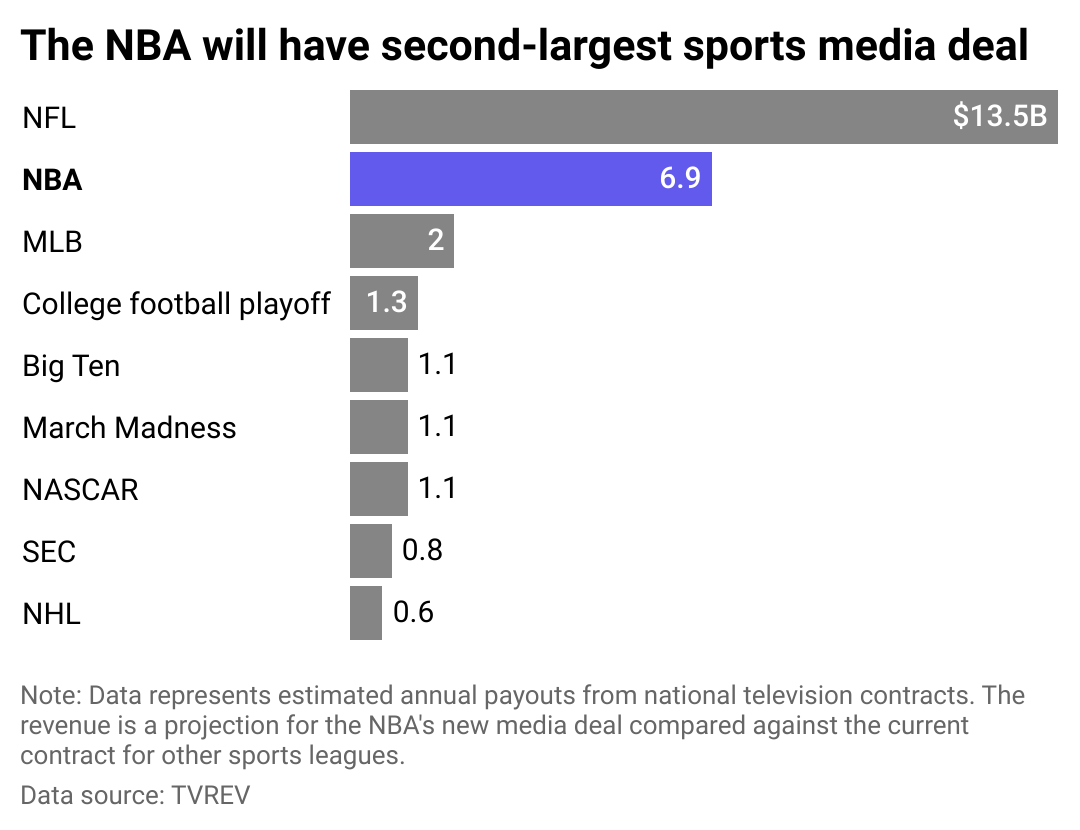

Media rights deal gaining ground on the NFL

The NBA already had the second-largest sports media deal behind the NFL, but it significantly stretched its advantage over Major League Baseball while gaining a foothold in the linear TV and streaming markets. The NFL is untouchable at the moment, but the NBA is catching up—it’s already attracting a bigger worldwide audience, according to TVREV, which produces reports and insights on the media.

It should lead to growth and innovation in the market, but viewers will also have to navigate a further stratified viewing landscape—a problem that always existed with cable TV and led to Netflix’s rise. If the deal successfully avoids those pitfalls and others, it could also clear a path that other leagues soon follow. More live streaming and digital viewing options also allow teams to gather valuable information about their fans that isn’t possible when airing via broadcast channels. These viewer insights could result in increased revenues.

Sqore

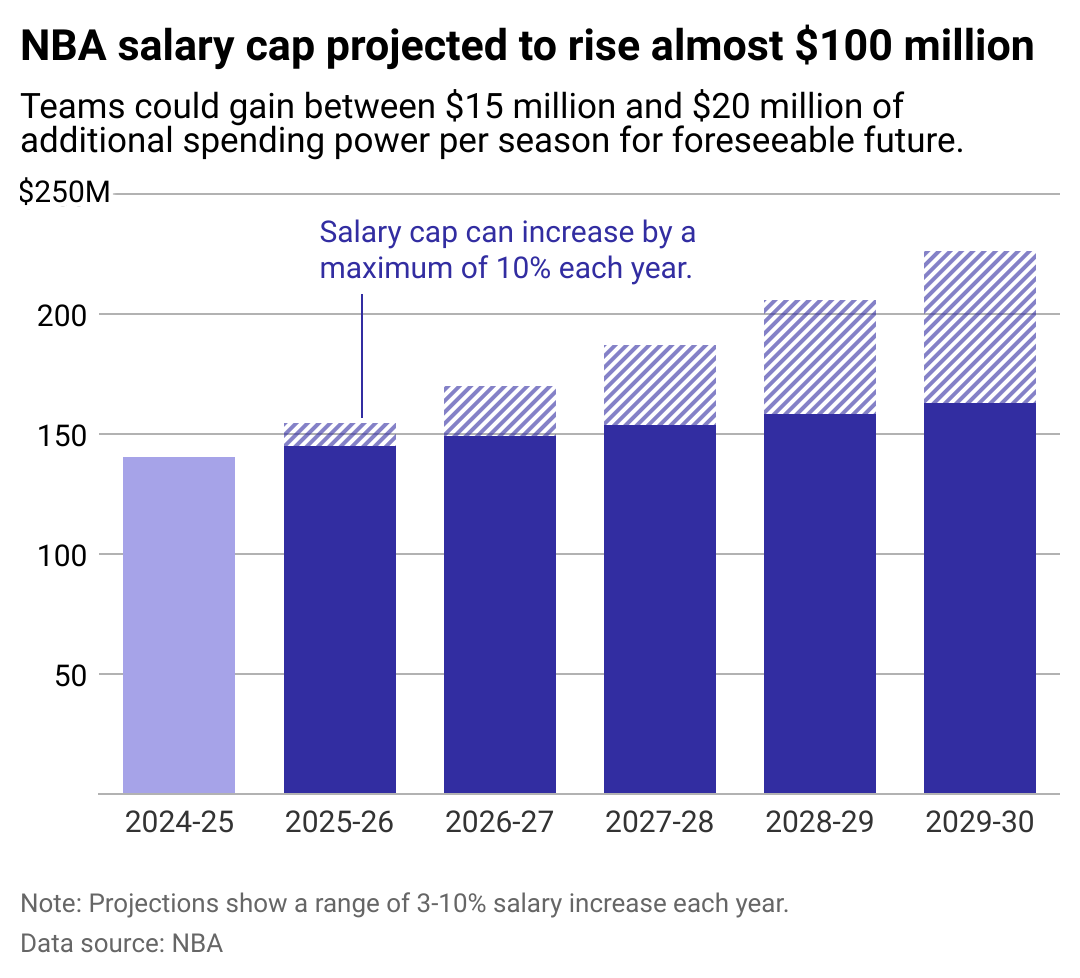

Salary cap projected to cross $200M

The last time the NBA signed a monumental TV deal, in 2014, it created a competitive balance problem. When the $24.2 billion contract with Disney and Turner kicked in two years later, the Golden State Warriors were coming off back-to-back NBA Finals appearances and a record 73-9 season. They still were able to spend $54.3 million over two years to sign Kevin Durant, one of the best players in the world. The Warriors won the following two titles and played for a third.

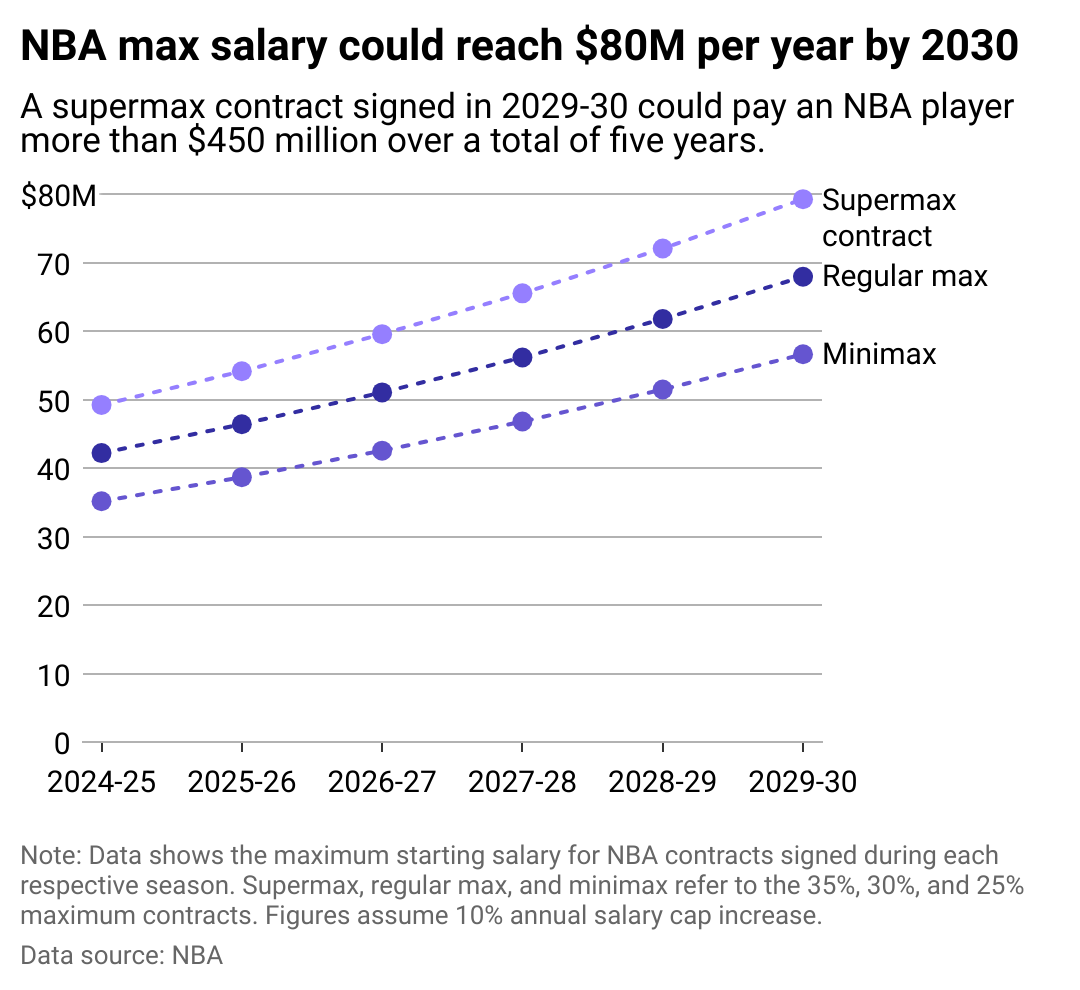

The league may have learned a valuable lesson. It will implement a smoothing process for this whopper of a deal, which means the salary cap will not rise by more than 10% annually.

Sqore

Some players set to make more than $1 million per game

The maximum 10% annual increase in the salary cap intends to spread the wealth among more players than just the 2025 free-agent class, unlike what happened in 2016.

The spike in 2016 enabled free agents to cash in, with 35 players earning $40 million. But others were left out in the cold: Just 32 players reached that threshold in the next two offseasons combined. And though Jayson Tatum of the Boston Celtics just signed the first $300 million contract, the first $400 million contract is already on the horizon.

That could lead to the fabled “discount,” when a player settles for less money to allow their team to sign another star or a better cast of supporting players. Of course, there will also be unintended or unforeseen consequences, which will no doubt be exploited by the NBA’s bounty of expertly analytical front offices.

Sqore

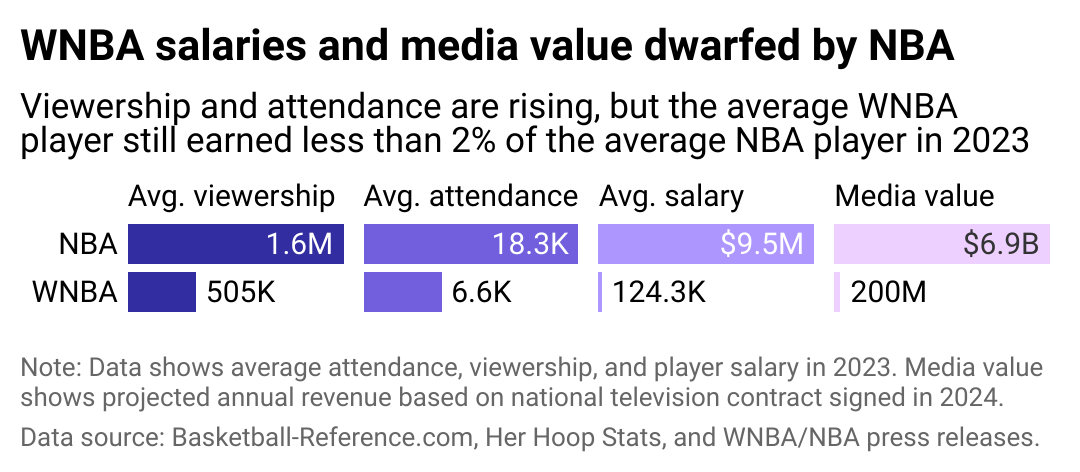

WNBA secures $140M revenue boost, but a gap remains

Though WNBA viewership and attendance figures are about one-third those of the NBA, its average salary and media rights are roughly 75 and 35 times smaller. The league was undervalued, according to a statement by Women’s National Basketball Players Association executive director Terri Jackson.

This media rights package is worth $2.2 billion to the WNBA, and the organization expects to bring in another $60 million per year with other rights deals. The WNBA’s current media deal is worth just $43 million annually. The bump, while seemingly substantial, is still perhaps not big enough. However, it will help at a time when women’s basketball is already more popular than ever. This season marked viewership, attendance, and other highs in the association’s 28-year history, and the ongoing playoffs are only ratcheting things up a notch.

The new deal includes a clause that allows it to be reevaluated after three years, which means Jackson and Co. could get that greater valuation. However, as The Next’s Howard Megdal reported, the incoming money seems set to fund charter flights and other general working condition upgrades rather than more substantial salaries.

Story editing by Carren Jao. Additional editing by Kelly Glass. Copy editing by Kristen Wegrzyn.

This story originally appeared on Sqore and was produced and

distributed in partnership with Stacker Studio.

5 charts that break down the NBA’s new media rights deal

#charts #break #NBAs #media #rights #deal