Why are ‘green’ projects unattractive to capital?

Photo courtesy of Holochain 2024

Opinions expressed by Digital Journal contributors are their own.

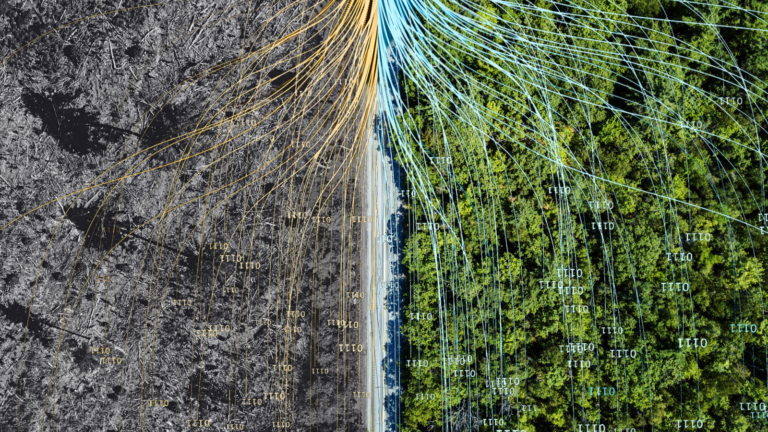

In a world grappling with the urgent need to address climate change, a puzzling question emerges: why are “green” projects, despite their potential for long-term benefits, often overlooked by investors?

As the green movement gains momentum, it is crucial to examine the factors that make sustainability efforts seemingly unattractive to capital and to find solutions to the reliability and auditability of current regenerative approaches.

Through the insights of experts like Pete Corke, Director of Vision & Leadership at Kwaxala, Professor William McCarthy at Michigan State University, and Arkology Studio co-founders Ross Eyre and Che Coelho, this article explores the complexities of the current economic paradigm and discover the opportunities for regenerative economics — all enabled by innovative accounting and new technical developments in data validation systems.

The extractive mindset fails to recognize the intrinsic value of living nature, creating a system where the only way to direct capital into protecting nature is through philanthropy. However, relying solely on philanthropic funds to compete with the extraction economy is insufficient, as these funds represent just a tiny fraction of the profits derived from the same extractive activities.

Pete Corke points out, “Living nature isn’t represented in it. It’s all dead and extracted nature. And in fact, the only way of creating value flow in the current system into protected nature is by literally burning the transactional medium, burning money through philanthropy.”

The lack of mechanisms for holding value in ecosystems and the services they provide poses a significant challenge to remote communities. Ultimately, these communities are forced to choose between participating in extractive industries that destroy the local land or finding work elsewhere, as the current economic system fails to provide viable alternatives that recognize the value of living nature.

Opportunities for regenerative economics

Pete emphasizes the importance of creating new systems of value that recognize the benefits of ecological thriving, so the local communities that steward these ecosystems can create financially and environmentally sustainable models.

“The whole point of the regenerative economics space is to create a much needed counterbalance to extractive economics ,” Pete explains.

Regenerative economics can provide a viable alternative to extractive industries by developing mechanisms that allow individuals and businesses to invest in and hold value in living natural assets. This includes the securitization of living assets and the generation of carbon credits, which can offer additional co-benefits such as increased biodiversity.

But a lot of “green” financial tools are obtuse and lack clear measures of validity. Addressing this, new data systems offer promising solutions for creating transparency and liquidity in regenerative economic systems. By enabling verifiable data layers, these technologies ensure trust and accountability in regenerative projects while empowering local communities through decentralization.

In particular, Holochain, a non-blockchain, Web3 application framework, allows for the distributed storage and processing of vast amounts of data, which is crucial for documenting ecosystem interactions and ensuring the integrity of regenerative assets. Leveraging Web3 tools can help create new financial products and value flows that support the transition towards a more sustainable and equitable future, addressing the challenges posed by the current extractive economic system.

Accounting for value flows and regeneration

Traditional accounting methods, particularly double-entry bookkeeping, have limitations in understanding the lived reality and supporting sustainability practices. Professor William McCarthy proposes the Resources-Events-Agents (REA) accounting model as a solution.

REA focuses on economic storytelling, keeping track of resources, events, and the people or companies involved. This detailed information provides a clearer picture of a company’s environmental impact and can help in making better decisions aligned with sustainability goals.

However, changing accounting systems is not easy, and computational viability remains a challenge. Nonetheless, with new technologies and a shift in mindset, REA could help companies tell a richer story of their impact on the world.

Designing regenerative systems

Interdisciplinary designers Che and Ross argue that prevailing technology often serves narrow corporate interests rather than empowering communities. To build technology capable of nurturing collective thriving, it’s necessary to look to the wisdom found in living systems. Key ingredients for regenerative value flows include diversity, interdependence, circularity, and feedback loops.

To create a truly regenerative economy, it’s not enough to simply envision digital infrastructure aligned with collective prosperity. There must be active work to change the legal and tax incentives that currently favor extractive industries over sustainable stewardship of natural resources.

The first step in this process is to bring legislators and other policy creators to the table. By engaging with these key decision-makers, it’s possible to advocate for policies that level the playing field between extractive and regenerative practices. This may include restructuring tax codes to reward companies that prioritize sustainability, implementing stricter regulations on polluting industries, and providing incentives for businesses that adopt regenerative practices.

Once the stage is set with the appropriate legal and policy frameworks, the power of market dynamics can be leveraged to drive the transition towards a regenerative economy. By creating a competitive market between extraction and stewardship, companies can be encouraged to invest in sustainable practices and technologies that benefit both people and the planet.

The future of regenerative economics

As the world faces the mounting challenges of climate change, the need for a paradigm shift towards regenerative economics has never been more pressing. The insights provided by experts like Pete Corke, Professor William McCarthy, and the Arkology team highlight the transformative potential of innovative technologies and collaborative efforts in driving change.

Web3 tools focused on data provenance and auditability offer promising solutions for creating transparency and liquidity in regenerative economic systems. These technologies enable the creation of verifiable data layers, which are essential for ensuring trust and accountability in regenerative projects while empowering local communities through decentralization.

The payoff could be immense, with applications ranging from secure and verifiable sustainability data to the creation of “nature certificates” in regenerative agriculture. By embracing regenerative practices, empowering communities, and leveraging the power of decentralized technologies, society can collectively work towards a more sustainable and equitable future.

It’s time for investors and decision-makers to recognize the long-term benefits of supporting green projects and sustainability efforts. The path forward may be complex, but the stakes are too high to ignore the call for action.

Efforts must unite to create an economic system that nurtures both people and the planet, and the time to act is now. The future of the world depends on willingness to embrace change and invest in a regenerative economy that benefits all.

Why are ‘green’ projects unattractive to capital?

#green #projects #unattractive #capital