Investor group raises bid for US retailer Macy’s to $6.6 bn

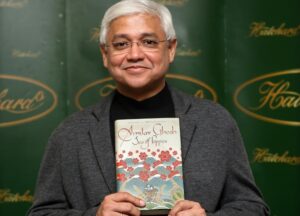

Macy’s has announced plans to close 150 ‘underproductive’ stores – Copyright GETTY IMAGES NORTH AMERICA/AFP/File Victor J. Blue

An investor group that offered to buy the struggling US department store chain Macy’s in December and was turned down said Sunday it has sweetened its bid.

Arkhouse Management and Brigade Capital Management, which originally offered $5.8 billion, have upped this by nearly $1 billion by now offering $24 per share, compared to $21 back in December. This values the takeover at $6.6 billion.

The new offer represents a 33.3 percent premium to where Macy’s shares closed Friday, these bidders said in a statement.

They also said they were offering more information about the proposed transaction including the fact that two other companies, Fortress Investment and One Investment Management, were taking part by offering money of theirs.

In January Macy’s rejected an unsolicited takeover proposal from Arkhouse and Brigade Capital Management.

Last week Macy’s, an iconic 166 year old retailer known for its famed Thanksgiving Day parade in New York, announced plans to close almost a third of its eponymous locations by 2026 while building up its upscale Bloomingdale’s and Bluemercury brands.

In January it said it would reduce its staff by 3.5 percent.

“We remain frustrated by the delay tactics adopted by Macy’s Board of Directors and its continued refusal to engage with our credible buyer group,” the investors said.

“While the restructuring plan Macy’s unveiled last week failed to inspire investors, the fourth quarter earnings and year-end results have given us further confidence in the long-term prospects of the Company if redirected as a private company,” the statement said.

Macy’s did not immediately respond to an AFP request for comment.

Macy’s said in its yearly report that it employed around 94,500 people and operated 722 stores as of the end of 2022. It now plans to close 150 of them.

Along with the new strategy it unveiled last week, the company released its year-end results for 2023, posting declining revenues and a sharp drop in profits.

Sales came in at $23.1 billion, down 5.5 percent from the previous year, the company said.

Net profits remained in the black at $105 million, but fell sharply by 91 percent.

Department stores have seen their results suffer for years as consumers increasingly move online, and have been forced to reduce in size — a dynamic exacerbated by the Covid-19 pandemic.

These trends have put pressure on shopping malls throughout the United States, particularly older retail sites that have fallen out of favor.

Investor group raises bid for US retailer Macy’s to $6.6 bn

#Investor #group #raises #bid #retailer #Macys