Russian aviation sector faces strong headwinds

As international sanctions bite, Russian politicians have pinned their hopes on building hundreds of home-made planes to replace the Western models.

But the main post-Soviet model — the Sukhoi Superjet –has a poor safety reputation – Copyright AFP Kazuhiro NOGI

Russia’s aviation industry is facing heavy turbulence, as concerns for passenger safety mount in the face of poor maintenance, a lack of spare parts and regular breakdowns.

The sector, heavily reliant on international suppliers, has been among the hardest hit by Western sanctions over Moscow’s assault on Ukraine.

Cut off from Europe’s Airbus and US-based Boeing, Russian airlines are facing particular trouble securing and maintaining both physical parts and advanced software needed to keep planes in the air, experts say.

“The conditions in which Russian airlines operate have certainly become much more difficult and the risks for the industry have obviously increased,” Oleg Panteleyev, director of AviaPort.ru, an agency specialising in the Russian aviation industry told AFP.

Several recent incidents have highlighted the concerns.

In August, passengers on a Red Wings flight were stuck in the Urals city of Yekaterinburg for 24 hours due to simultaneous “technical malfunctions” on the only two available aircraft.

The company pointed to “external sanctions” and “restrictions on the supply of spare parts, which complicates aircraft maintenance” in a press release.

The same month a Russian Pegas Fly plane was delayed in Thailand due to faults with its weather monitoring system.

At the start of October, Flagcarrier Aeroflot suffered three technical failures to its planes in a single day.

The Kremlin has acknowledged that all is not well in Russia’s aviation industry.

“We are facing new challenges, and we are looking for new ways to resolve them,” Kremlin spokesman Dmitry Peskov said, when asked about the headwinds buffetting Russia’s aviation sector.

Several Russian airlines and the federal aviation agency did not respond to AFP requests to comment.

– Escalating risks –

The majority of planes operated by Russian airlines are made by either Airbus or Boeing, Western companies that have stopped doing business with Russia.

The main problems for Russian airlines centre around engine maintainance and computer systems.

S7, Russia’s largest private airline, will reduce the number of flights by 10-15 percent over the 2023-2024 autumn/winter period due to maintenance problems concerning the US-made engines for its Airbus planes, Russian media reported.

Unable to secure original parts for their Western-made jets, Russian companies have resorted to cannibalising their existing fleet — grounding entire planes to strip them for parts.

Such a solution is seen as a short-term fix.

Russia is no stranger to air disasters as a result of pressure on the industry.

The country saw a string of crashes that killed hundreds in the 1990s and early 2000s, due to an ageing Soviet fleet and poorly maintained aircrafts.

Permanently cutting down on air travel altogether is also a non-starter in a country that spans 11 time zones.

Western countries, including the European Union, United States and Britain, have banned Russian airlines from operating in their airspace.

So far, domestic air traffic inside Russia has not fallen since the start of Russia’s offensive on Ukraine.

The Aviation Safety Network (ASN) also reported the number of aviation incidents in Russia over the period has stayed within the range recorded in previous years.

But as time passes, the risks are likely to increase.

– Domestic replacements? –

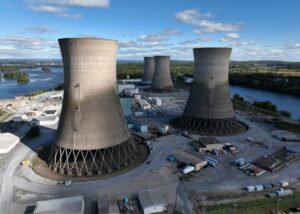

Russian politicians have pinned their hopes on building hundreds of home-made planes to replace the Western models.

But Russia’s recent record of making planes is patchy.

The country’s main post-Soviet model — the Sukhoi Superjet — already had a reputation as prone to breakdowns and accidents even before Western sanctions.

Plans for a new medium-haul jet, the Irkut MS-21, have fallen far behind schedule.

In April, a Russian airline association expressed concern over the slow production schedule for new domestic planes that they hope will replace their Western-made fleet.

“Maintaining the airworthiness of the foreign aircraft we have requires significant expenditure,” the Russian Association of Air Transport Operators said in a report.

Unless Moscow succeeds in either circumventing Western sanctions to secure aircraft parts or flying under-maintained planes, Russia’s fleet numbers could drop by more than a third — from 850 to 554 — by 2033, analysts at consultancy Oliver Wyman say.

Almost two years into the Ukraine conflict, Kyiv has revelled in the turbulence facing the Russian industry as a result of sanctions.

After the Russian Pegas Fly plane was temporarily grounded in Thailand earlier this year, Ukrainian presidential advisor Andriy Yermak wrote on social media: “We will do everything we can to ensure more news like this.”

Russian aviation sector faces strong headwinds

#Russian #aviation #sector #faces #strong #headwinds